In today’s rapidly evolving global economy, the lines between various academic and professional disciplines are increasingly blurring, giving rise to powerful new fields. One such critical area is CS Finance, often referred to as Computational Finance or Financial Engineering. This interdisciplinary domain leverages the robust analytical power of computer science and quantitative methods to solve complex problems within the financial industry. It represents a paradigm shift in how financial decisions are made, strategies are developed, and risks are managed, moving away from purely qualitative assessments towards data-driven, algorithmic approaches. Understanding CS Finance is essential for anyone looking to navigate the modern financial landscape, whether as an investor, a professional, or a student seeking to make an impact.

What Exactly is CS Finance?

CS Finance, at its core, is the application of computer science, numerical methods, and mathematical modeling to practical problems in finance. It involves developing and implementing sophisticated algorithms and software to analyze vast datasets, predict market movements, manage portfolios, price derivatives, and optimize trading strategies. This field demands a strong foundation in programming, statistics, calculus, and financial theory, allowing professionals to build tools that automate and enhance financial processes. It’s not just about using computers in finance; it’s about integrating computational thinking into the very fabric of financial operations, fostering innovation and efficiency across all sectors.

Key Pillars of Computational Finance

The strength of computational finance lies in its multidisciplinary foundation, drawing expertise from several distinct yet interconnected fields. Mastery in these areas is crucial for anyone aspiring to excel in this dynamic domain, as they form the bedrock upon which all computational financial models and strategies are built.

Computer Science and Programming Expertise

This forms the technological backbone of CS Finance. Professionals must possess strong skills in data structures, algorithms, and object-oriented programming. Proficiency in languages such as Python, C++, and Java is essential for developing efficient, scalable software and models used in various financial applications, from high-frequency trading systems to sophisticated risk assessment tools.

Quantitative Mathematics and Statistics

A deep understanding of advanced mathematics and statistics is non-negotiable for success in this field. This includes calculus, linear algebra, probability theory, stochastic processes, and statistical inference. These disciplines provide the analytical tools necessary to build sophisticated financial models, understand market randomness, quantify risks, and derive robust solutions for complex financial problems with precision.

Foundational Financial Theory and Economics

Computational models are only as good as their underlying financial logic. Therefore, a solid grasp of financial markets, investment instruments, portfolio theory, corporate finance, and micro/macroeconomics is indispensable. This knowledge ensures that the computational tools developed are not only technically sound but also financially relevant, ethical, and effective in real-world market scenarios.

Data Science and Machine Learning Applications

With the exponential growth of financial data, expertise in data science and machine learning has become increasingly vital. Skills in data mining, predictive modeling using advanced algorithms (e.g., neural networks, regression), and big data technologies allow for the extraction of valuable insights, identification of complex market patterns, and enhancement of forecasting capabilities, pushing the boundaries of financial analysis.

Transformative Applications of CS Finance

The impact of computational finance is far-reaching, fundamentally changing how financial institutions operate and innovate. Its applications span various critical areas, delivering precision and efficiency previously unimaginable, and continuously driving new opportunities within the market.

- Algorithmic Trading and High-Frequency Trading (HFT): Developing automated systems that execute trades based on predefined rules and market conditions, often at incredibly high speeds, to capitalize on fleeting price discrepancies and market inefficiencies.

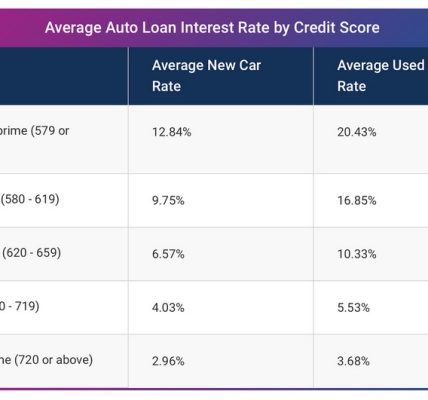

- Quantitative Risk Management: Building sophisticated models to measure, monitor, and manage various financial risks, including market risk, credit risk, and operational risk. This enables institutions to make more informed decisions and adhere to regulatory requirements.

- Financial Modeling and Simulation: Creating complex mathematical models to simulate market scenarios, price derivative instruments, evaluate investment strategies, and forecast financial outcomes under different conditions, aiding in strategic planning.

- Portfolio Optimization: Utilizing advanced algorithms to construct and rebalance investment portfolios that maximize returns for a given level of risk or minimize risk for a target return, often incorporating factors like diversification and asset allocation.

- FinTech Innovation: Driving the development of new financial technologies, such as blockchain applications for finance, automated advisory services (robo-advisors), and peer-to-peer lending platforms, making financial services more accessible and efficient for everyone.

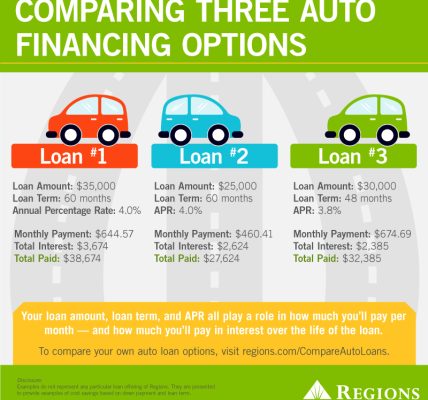

Comparing Traditional and Computational Finance Approaches

To better understand the distinct advantages offered by computational finance, it’s helpful to compare its approach to traditional financial methodologies across key operational areas. This table highlights how technology and quantitative methods fundamentally alter problem-solving in the modern financial landscape.

| Aspect | Traditional Finance Approach | Computational Finance Approach |

|---|---|---|

| Data Analysis | Manual review of reports, limited datasets, qualitative insights, spreadsheet-based analysis, often retrospective. | Automated processing of vast datasets, real-time analytics, machine learning for pattern recognition, predictive modeling, forward-looking. |

| Trading Decisions | Discretionary decisions based on human judgment, fundamental analysis, and experience, slower execution. | Algorithm-driven execution, high-frequency trading, statistical arbitrage, programmatic strategy backtesting, ultra-fast. |

| Risk Management | Periodic, retrospective analysis; reliance on historical data and expert opinions; static models, often reactive; | Real-time risk aggregation, dynamic stress testing, Monte Carlo simulations, quantitative risk factor modeling, proactive and adaptive. |

| Product Development | Intuitive design, market research, incremental innovation, often slow to adapt to new market conditions. | Data-driven product design, rapid prototyping, A/B testing, complex derivative pricing models, rapid iteration and customization. |

| Efficiency & Speed | Labor-intensive, prone to human error, slower execution, limited scalability, higher operational costs. | Automated, highly accurate, lightning-fast execution, easily scalable operations, significantly reduced operational costs, enhanced reliability. |

Essential Skills for CS Finance Professionals

A successful career in Computational Finance demands a diverse skill set that bridges the gap between complex financial markets and cutting-edge technological solutions. Professionals in this field are continuous learners, adapting to new tools and methodologies to stay ahead in a dynamic environment.

- Strong Programming Proficiency: Expertise in languages like Python (for data science/ML), C++ (for performance-critical systems), Java (for enterprise applications), and potentially R or MATLAB is crucial for developing and implementing financial models and trading systems.

- Advanced Quantitative Acumen: A solid foundation in calculus, linear algebra, probability, statistics, and stochastic processes is necessary for model building, risk assessment, and data interpretation.

- Deep Financial Market Knowledge: Understanding financial products, market structures, economic principles, and regulatory environments provides essential context for applying computational techniques effectively and making informed decisions.

- Problem-Solving and Analytical Thinking: The ability to break down complex financial problems into solvable components, analyze data critically, and devise innovative, data-driven solutions is paramount.

- Data Management and Machine Learning: Skills in handling large datasets, database management (SQL, NoSQL), and applying machine learning algorithms for predictive analytics and pattern recognition are increasingly vital for extracting value from financial data.

- Communication Skills: Translating complex technical and quantitative findings into understandable insights for non-technical stakeholders, as well as collaborating effectively within interdisciplinary teams, is a key soft skill.

Frequently Asked Questions About CS Finance

What is the difference between CS Finance and FinTech?

While often intertwined, CS Finance focuses more on the quantitative and algorithmic aspects of financial problem-solving, such as complex modeling, derivatives pricing, and high-frequency trading strategies. FinTech (Financial Technology) is a broader term encompassing any technology that aims to improve and automate the delivery and use of financial services, including mobile banking, payment apps, and blockchain, often utilizing CS Finance techniques as underlying components to build innovative products.

What programming languages are most important for CS Finance?

Python is extremely popular due to its extensive libraries for data analysis, machine learning, and scientific computing, making it ideal for prototyping and quantitative analysis. C++ is crucial for high-performance applications like high-frequency trading where speed is paramount. Java is also widely used, particularly in large enterprise-level financial systems, and R is favored for statistical analysis and visualization.

Is a background in both Computer Science and Finance necessary?

Ideally, yes, or at least a strong understanding of both. Many professionals enter the field from a computer science or mathematics background and acquire financial knowledge on the job or through specialized courses, or vice versa. Specialized master’s programs in Financial Engineering or Quantitative Finance are specifically designed to bridge this gap, providing a comprehensive interdisciplinary education.

What are typical job roles in Computational Finance?

Common roles include Quantitative Analyst (Quant), who develops mathematical models and algorithms; Algorithmic Trader, designing and managing automated trading systems; Financial Modeler, building simulation and valuation tools; Risk Analyst, assessing and mitigating financial risks using quantitative methods; and FinTech Developer, creating innovative financial software and platforms that leverage computational techniques.