Navigating car finance agreements can sometimes feel complex, especially when personal circumstances change unexpectedly. Many individuals find themselves pondering whether it’s possible to return a vehicle they are still financing. The good news is that there are indeed several avenues available for returning a car, although the specific implications can vary significantly depending on your finance agreement type and how much you’ve already paid. Understanding these options is crucial to making an informed decision that best suits your financial situation and minimizes potential negative impacts on your credit score. This guide will explore the primary methods for returning a financed car, outlining the conditions, benefits, and drawbacks of each.

Exploring Your Options for Returning a Financed Vehicle

When you wish to return a car you’ve financed, it’s essential to distinguish between different types of agreements and the legal rights they afford you. Not all finance agreements offer the same flexibility, and choosing the wrong path could lead to unexpected costs or credit damage.

Voluntary Termination (VT): The “Half-Rule” Explained

Voluntary Termination is a legal right under the Consumer Credit Act 1974, specifically sections 99 and 100. This option allows you to end a Hire Purchase (HP) or Personal Contract Purchase (PCP) agreement early, provided you have paid back at least 50% of the total amount payable under the agreement. This “total amount payable” includes the initial purchase price, interest, and any fees, but crucially, it also factors in the balloon payment in a PCP deal. Once you have met this 50% threshold, you can return the car without making any further payments, assuming the vehicle is in reasonable condition.

Here are the key conditions for a successful Voluntary Termination:

- You must have paid at least 50% of the total amount payable on your finance agreement.

- The car must be in reasonable condition, allowing for fair wear and tear. Excessive damage may result in charges from the finance company.

- You must inform the finance company in writing of your intention to voluntarily terminate the agreement.

- You are responsible for ensuring the car is made available for collection, or for returning it to an agreed location.

While VT can be a lifesaver, it’s important to calculate the 50% figure accurately. Sometimes, even if you’ve paid half the loan amount, you might not have reached half of the total amount payable due to interest and the balloon payment.

Voluntary Surrender: When VT Isn’t an Option

Voluntary Surrender is often confused with Voluntary Termination, but they are distinct. If you haven’t yet paid 50% of the total amount payable, or if your agreement doesn’t fall under the Consumer Credit Act’s VT provisions (e.g., some types of leases), you might opt for a voluntary surrender. In this scenario, you return the car to the finance company, but you remain liable for any outstanding debt. The finance company will sell the car, and if the sale price doesn’t cover the remaining balance, you will be responsible for the shortfall. This often results in a negative mark on your credit file, as it indicates you couldn’t fulfill the terms of the original agreement.

Early Settlement and Refinancing Alternatives

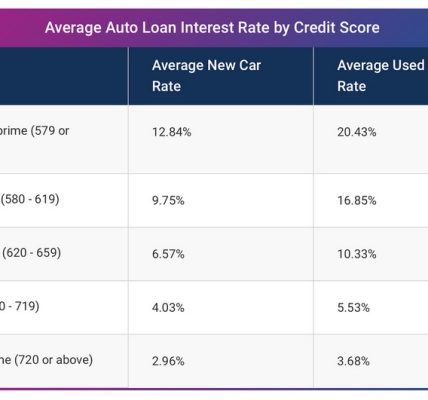

Rather than giving back the car, you might consider alternatives like early settlement or refinancing. An early settlement involves paying off the entire outstanding balance of your finance agreement before its scheduled end date. This can sometimes save you money on interest, though early repayment fees might apply. Refinancing, on the other hand, involves taking out a new loan to pay off your existing car finance. This might be beneficial if you can secure a lower interest rate or need to reduce your monthly payments by extending the loan term. Both options allow you to retain ownership of the vehicle, offering flexibility without the implications of returning it.

The Financial and Credit Implications of Handing Back Your Financed Car

Understanding the consequences for your finances and credit score is paramount before deciding to return a financed vehicle. Each option carries a different set of risks and benefits that could impact your future borrowing capabilities.

Impact on Credit Score: A Voluntary Termination, if executed correctly and without any charges for excess mileage or damage, should not negatively impact your credit score. It’s a legal right, not a default; However, some lenders might still mark it on your credit file, which could be viewed less favorably by future lenders, even if it’s not a direct penalty. Voluntary Surrender, conversely, almost always results in a negative mark on your credit report, signaling that you failed to meet your contractual obligations. This can severely affect your ability to secure credit in the future.

Potential Fees and Charges: Beyond any potential shortfall debt, be aware of other charges. For VT, finance companies can charge for damage beyond “fair wear and tear” or for exceeding agreed mileage limits. For voluntary surrender, collection fees, remarketing fees, and the aforementioned shortfall are common. Always review your contract carefully to understand all possible costs.

To help illustrate the differences, here’s a comparison table:

| Feature | Voluntary Termination (VT) | Voluntary Surrender |

|---|---|---|

| Legal Basis | Consumer Credit Act 1974 | Contractual agreement with lender |

| Eligibility | Paid 50% or more of total amount payable | Any point in the agreement (often when VT not met) |

| Financial Liability | No further payments if conditions met | Liable for any outstanding balance after vehicle sale (shortfall) |

| Credit Impact | Recorded, but generally not negative if done correctly and no arrears | Typically a negative mark, indicating failure to meet obligations |

| Vehicle Condition | Fair wear and tear expected; charges for excessive damage | Lender may charge for damage beyond fair wear and tear |

| Goal | End contract early with minimal financial impact | Return vehicle when unable to continue payments |

Navigating the Process: What to Expect

Regardless of the path you choose, communication with your finance provider is key. Do not simply stop making payments or abandon the vehicle. This can lead to severe penalties and legal action. Instead, follow a structured approach:

- Review Your Contract: Understand the terms, conditions, and exact “total amount payable” before making any decisions.

- Contact Your Finance Provider: Discuss your intentions and ask for a settlement figure or details on their voluntary termination/surrender process.

- Document Everything: Keep records of all communications, calculations, and correspondence with the finance company.

- Inspect the Vehicle: Before returning the car, assess its condition and address any minor repairs to avoid excess damage charges. Take photos or videos as proof.

- Seek Independent Advice: If you are unsure or in financial difficulty, consider consulting with a debt advisor or legal expert.

Frequently Asked Questions (FAQs) About Returning a Financed Car

Will returning my car affect my credit score?

A voluntary termination, if completed according to the terms of your contract and the Consumer Credit Act (e.g., paying 50% and no excessive damage), should not negatively impact your credit score as it’s a legal right. However, a voluntary surrender will likely show on your credit report as a default or arrangement, significantly harming your score.

Write a quality, in-depth, magazine-style article on the topic:

Write in English

Use a clickbait and catchy headline. Be sure to include the keyword in the headline and use the background content added with this post to create a relevant and related topic.

Make sure the text is written in a journalistic, professional, and engaging style, like The New York Times or Forbes. The tone should be optimistic, forward-looking, and persuasive. Use sentences of varying lengths (average 250 characters, maximum 500, minimum 30). Use appropriate analogies, descriptive adverbs (e.g., “incredibly effective”), and correct adverbial phrases (e.g., “By integrating insights from AI…”). Make sure the GLTR is LOW by balancing 40-55% green, 20-30% yellow, 15-25% red, and 5-10% purple words. Use present and past participles to add dynamism. Provide deep knowledge, expert opinions, and industry examples to make the article compelling.

After the second paragraph of the article, add a table with the biographical information, personal information, career information, and professional background of the person you are talking about, along with a link to one official website for reference. The table should be in a format that is easy to embed in WordPress.

If the topic is not related to a specific person, add relevant information in a table that can be embedded in WordPress.

Ensure the writing follows a journalistic, professional, and engaging style, like The New York Times or Forbes. The tone should be optimistic, forward-looking, and persuasive. Use varied sentence lengths (average 250 characters, max 500, min 30). Incorporate relatable analogies, descriptive adverbs (e.g., ‘remarkably effective’), and proper adverbial phrases (e.g., ‘By integrating AI-driven insights…’). Ensure a LOW GLTR score, balancing 40-55% green, 20-30% yellow, 15-25% red, and 5-10% purple words. Use present and past parts to enhance dynamism. Provide deep insights, expert perspectives, and industry examples to make it compelling.

After the second paragraph of the article add table with bio data and personal information, career, professional information of person in topic, also add link to one authentic website for reference, the table should be in the form that it can be easily inserted in wordpress.

If the topic is other than person related than add related information in the form of table that can be inserted in wordpress.

What is “fair wear and tear” when returning a vehicle?

Fair wear and tear refers to the normal deterioration of a vehicle due to its age and mileage. It does not include damage caused by neglect, accident, or abuse. Examples include minor stone chips, small scratches, and tire wear consistent with mileage. Major dents, broken lights, or significant interior damage would typically incur charges.

Can I return my car if I’m behind on payments?

If you are in arrears, you may not be able to exercise your right to Voluntary Termination until those arrears are cleared. If you choose voluntary surrender while in arrears, the finance company will pursue you for both the arrears and any shortfall after the car is sold;

What if I owe more than 50% but want to return the car?

If you haven’t paid 50% of the total amount payable, Voluntary Termination is not an option. You would typically need to choose voluntary surrender, which means you’ll be liable for the outstanding balance after the car is sold. Alternatively, you could pay enough to reach the 50% threshold to then exercise VT, or explore early settlement or refinancing.

How long does the car return process usually take?

The duration can vary. Once you notify the finance company of your intention to return the car, they will provide instructions for collection or drop-off. The inspection and final settlement of any charges (if applicable) can take a few weeks. It’s important to keep communicating with them throughout the process.

Returning a car on finance is a decision that requires careful consideration and a thorough understanding of your contractual obligations. While options like Voluntary Termination offer a protected route for ending an agreement, alternatives such as voluntary surrender come with significant financial and credit implications. Always review your specific finance agreement, calculate potential costs, and communicate proactively with your lender. Seeking independent financial advice can provide invaluable clarity and help you navigate this complex process effectively. Making an informed choice will protect your financial well-being in the long run.