The landscape of modern finance is constantly evolving, presenting both opportunities and challenges for individuals seeking to align their financial activities with their ethical and religious beliefs. For many Muslims, the question of whether investing in the stock market is permissible under Islamic law, or “halal,” is a significant concern. This query stems from core Islamic principles that govern financial transactions, emphasizing fairness, transparency, and social responsibility. Exploring this topic requires a nuanced understanding of Islamic finance and the practical application of its tenets to contemporary investment vehicles. It is essential to delve into specific criteria and guidelines to ensure that one’s investment portfolio adheres to Sharia principles.

Understanding Halal Principles in Finance

Islamic finance operates on fundamental principles derived from the Quran and Sunnah, aiming to foster economic justice and avoid practices deemed unethical or exploitative. Central to these principles is the prohibition of Riba (interest), as it is considered exploitative and unjust. Another key prohibition is Gharar (excessive uncertainty or speculation), which discourages transactions with ambiguous outcomes, akin to gambling. Maysir (gambling) is also strictly forbidden due to its speculative nature and potential for harm.

Write a quality, in-depth, magazine-style article on the topic:

Write in English

Use a clickbait and catchy headline. Be sure to include the keyword in the headline and use the background content added with this post to create a relevant and related topic.

Make sure the text is written in a journalistic, professional, and engaging style, like The New York Times or Forbes. The tone should be optimistic, forward-looking, and persuasive. Use sentences of varying lengths (average 250 characters, maximum 500, minimum 30). Use appropriate analogies, descriptive adverbs (e.g., “incredibly effective”), and correct adverbial phrases (e.g., “By integrating insights from AI…”). Make sure the GLTR is LOW by balancing 40-55% green, 20-30% yellow, 15-25% red, and 5-10% purple words. Use present and past participles to add dynamism. Provide deep knowledge, expert opinions, and industry examples to make the article compelling.

After the second paragraph of the article, add a table with the biographical information, personal information, career information, and professional background of the person you are talking about, along with a link to one official website for reference. The table should be in a format that is easy to embed in WordPress.

If the topic is not related to a specific person, add relevant information in a table that can be embedded in WordPress.

Ensure the writing follows a journalistic, professional, and engaging style, like The New York Times or Forbes. The tone should be optimistic, forward-looking, and persuasive. Use varied sentence lengths (average 250 characters, max 500, min 30). Incorporate relatable analogies, descriptive adverbs (e.g., ‘remarkably effective’), and proper adverbial phrases (e.g., ‘By integrating AI-driven insights…’). Ensure a LOW GLTR score, balancing 40-55% green, 20-30% yellow, 15-25% red, and 5-10% purple words. Use present and past parts to enhance dynamism. Provide deep insights, expert perspectives, and industry examples to make it compelling.

After the second paragraph of the article add table with bio data and personal information, career, professional information of person in topic, also add link to one authentic website for reference, the table should be in the form that it can be easily inserted in wordpress.

If the topic is other than person related than add related information in the form of table that can be inserted in wordpress.

Furthermore, investments in industries involved in haram (forbidden) activities are strictly prohibited. These include businesses dealing in alcohol, pork products, conventional banking (due to interest), weapons manufacturing, pornography, and other activities deemed harmful to society. A halal investment must therefore ensure that the underlying business operations are entirely permissible.

Is Stock Market Investment Halal? The Nuances

The stock market itself is not inherently haram. It represents a marketplace for buying and selling shares of ownership in companies. If a company’s primary business activities align with Sharia principles, investing in its shares can be considered halal. The challenge lies in identifying such companies and ensuring that their financial structure and operations do not violate Islamic law.

Many conventional companies, even if their core business is halal, might engage in some interest-based transactions or have debt levels that are too high according to Islamic finance standards. This necessitates a careful screening process to filter out non-compliant entities. The permissibility hinges on both the nature of the business and its financial health according to specific Sharia metrics.

Sharia Screening Criteria for Halal Stocks

To determine if a stock is Sharia-compliant, investors typically rely on a set of screening criteria. These criteria assess both the company’s business activities and its financial ratios.

- Business Activity: The primary source of income for the company must be halal. Companies involved in alcohol, tobacco, pork, conventional banking, insurance, gambling, adult entertainment, or weapons are excluded.

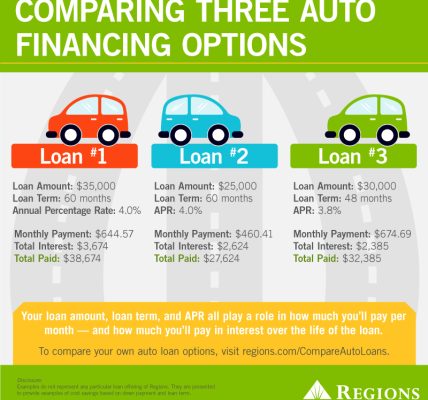

- Financial Ratios: Several financial ratios are scrutinized to ensure the company’s reliance on interest-based income or debt is minimal. Common benchmarks (though they can vary slightly among scholars) include:

- Interest-Bearing Debt: Total interest-bearing debt should not exceed 33% of the company’s market capitalization or total assets.

- Interest-Based Income: Income from interest (e.g., from conventional investments or deposits) should not exceed 5% of the company’s total revenue.

- Liquid Assets: Cash and receivables should not exceed 49% of the company’s total assets.

- Purification (Zakat and Sadaqah): Even if a company passes the initial screenings, if a small percentage of its income is derived from impermissible sources (e.g., interest on bank deposits), investors may be required to “purify” that portion of their earnings by donating it to charity (sadaqah) without intending it as reward.

Practical Steps for Halal Investing

Navigating the stock market while adhering to Islamic principles requires a systematic approach. Investors have several avenues to pursue Sharia-compliant investments.

| Step | Description |

|---|---|

| Research Sharia-Compliant Indices & Funds | Look for publicly available Sharia-compliant indices (e.g., Dow Jones Islamic Market Index, FTSE Global Islamic Index) or dedicated Islamic exchange-traded funds (ETFs) and mutual funds. These are pre-screened by Sharia boards. |

| Utilize Halal Stock Screeners | Use online tools or platforms that screen individual stocks based on the aforementioned Sharia criteria. Many financial platforms now offer this feature. |

| Consult Islamic Scholars or Advisors | For complex situations or specific investment choices, seek guidance from qualified Islamic finance scholars or financial advisors specializing in Sharia-compliant investments. |

| Regular Portfolio Review | Companies’ financial situations and business activities can change. Periodically review your investments to ensure they remain Sharia-compliant. |

| Purification of Impermissible Income | If a small, unavoidable portion of your investment returns comes from haram sources, calculate and donate that amount to charity. |

FAQs on Halal Stock Market Investing

Q1: Are all stocks inherently halal if the company’s main business is permissible?

No, not necessarily. While the primary business activity must be halal, the company’s financial structure also matters. High levels of interest-bearing debt or significant interest-based income can render a stock non-compliant, even if its core business is permissible.

Q2: What if a company has a small amount of haram income, like interest from bank deposits?

Most Sharia screening methodologies allow for a small percentage (typically up to 5%) of total revenue to come from impermissible sources. However, any income derived from these sources must be “purified” by donating that specific portion to charity.

Q3: Can I invest in conventional banks or insurance companies?

Generally, no. Conventional banks and insurance companies operate on interest-based models (Riba) and Gharar, respectively, which are prohibited in Islamic finance. There are specific Islamic banking and Takaful (Islamic insurance) models that are Sharia-compliant.

Q4: What are Sharia-compliant ETFs or mutual funds?

These are investment vehicles that pool money from multiple investors to buy a portfolio of stocks that have been pre-screened and certified as Sharia-compliant by a panel of Islamic scholars (Sharia board). They offer a convenient way for Muslims to invest ethically.

Investing in the stock market can indeed be halal, provided that investors meticulously follow Islamic principles and conduct thorough due diligence. It requires a clear understanding of what constitutes a permissible business activity and an adherence to specific financial screening criteria. By choosing Sharia-compliant companies and actively managing one’s portfolio, Muslims can participate in capital markets while upholding their faith. This approach not only ensures ethical financial practices but also contributes to the growth of a responsible and just economic system. The availability of Sharia-compliant indices and expert advice further simplifies this journey for modern investors.